How Next-Gen Geothermal Financing is Evolving at the Level of Innovation Clusters, Firms, and Technologies

Abstract

BRIEF DESCRIPTION

Underground Ventures has collected investment data from 2008 to 2025 H1, which shows how geothermal financing is evolving at the level of innovation clusters, firms, and technologies. The research tracks the growth of next-generation geothermal technologies necessary to grow geothermal energy production. Among other insights, we show how types of financing are changing as risk profiles change, how oil and gas corporates continue to be integral, how North American clusters import capital from Europe, the key role of American capital markets, and the investment - or lack of - into specific technology segments in deep geothermal energy.

EXTENDED ABSTRACT

In our research, 183 funding rounds have been analyzed, covering 62 geothermal companies and 219 investors. In the largest study of its kind, we demonstrate:

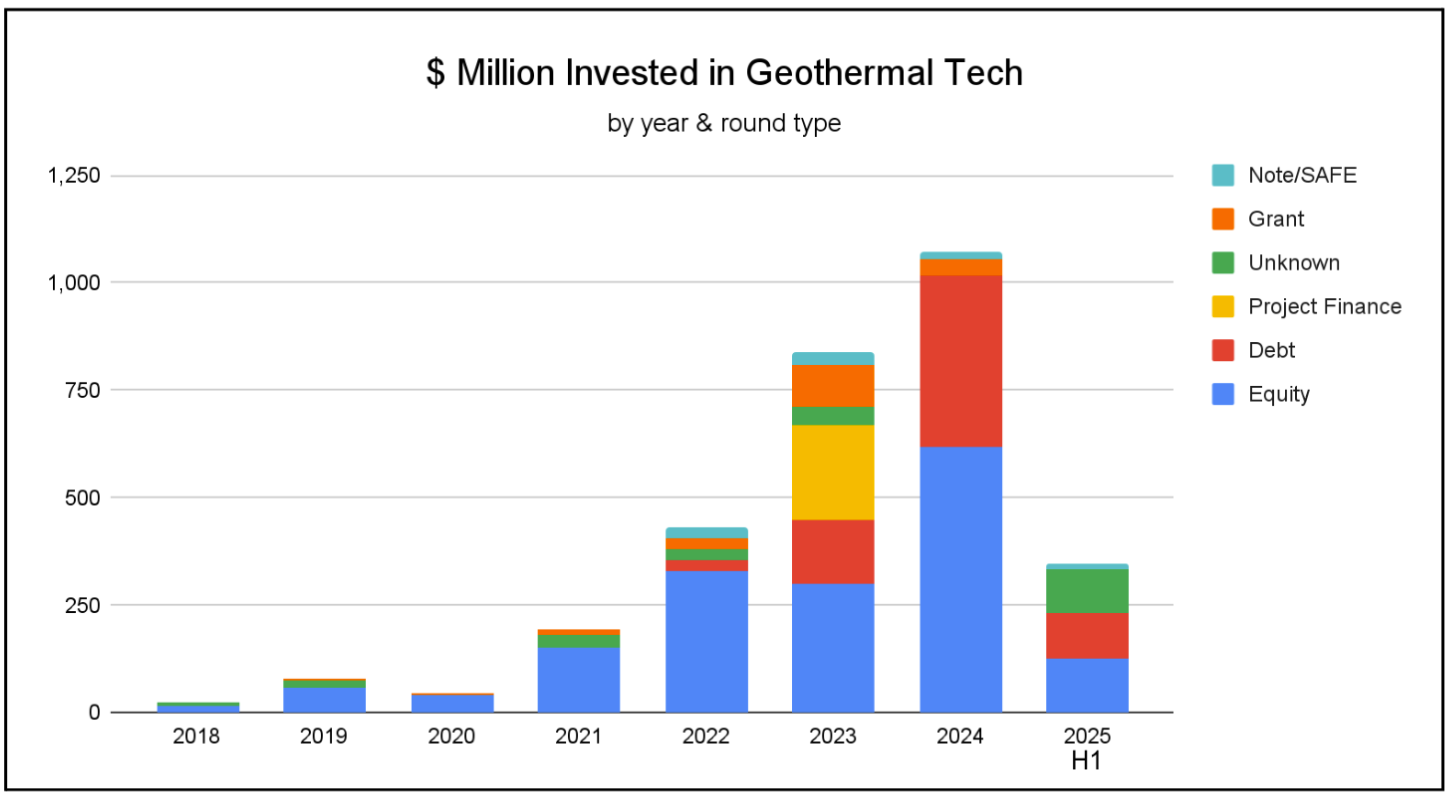

(1) Capital invested in geothermal tech has grown rapidly, and the type of financing has evolved from grants and equity to debt and infrastructure as startups mature and de-risk. This is mostly driven by tech-enabled project developers, who have more predictable future revenues compared to companies selling technology products. In the first half of 2025, less capital was raised compared to the two preceding years, and therefore this year is likely to bring an overall decrease in investments. We do not conclude that this breaks the growth trend, because it is still within a reasonable range of deviation given that the overall fundraising is driven especially by a few firms.